Introducing W4.0

Direct access to Neil Woodford’s proven investment strategies.

The Housing Minister's Housing Problem

The housing minister's interview in the FT reveals a profound lack of understanding of private enterprise, supply and demand, and the real reasons behind Britain's depressed housing market. The facts tell a very different story to the one Matthew Pennycook is selling.

The Housing Minister's Housing Problem

The housing minister's interview in the FT reveals a profound lack of understanding of private enterprise, supply and demand, and the real reasons behind Britain's depressed housing market. The facts tell a very different story to the one Matthew Pennycook is selling.

Mental cleansing

A year-end act of economic “letting go”. From productivity myths and phantom fiscal black holes to gloomy forecasters and broken models, this is a reminder of just how wrong the consensus repeatedly was.

Mental cleansing

A year-end act of economic “letting go”. From productivity myths and phantom fiscal black holes to gloomy forecasters and broken models, this is a reminder of just how wrong the consensus repeatedly was.

Roundup of the week: Inflation Falls Faster Than Expected in US and UK

A quiet end to the year, but with one big surprise: inflation in both the US and UK has fallen much faster than expected — strengthening the case for quicker and deeper rate cuts in 2026.

Roundup of the week: Inflation Falls Faster Than Expected in US and UK

A quiet end to the year, but with one big surprise: inflation in both the US and UK has fallen much faster than expected — strengthening the case for quicker and deeper rate cuts in 2026.

UK Budget: Noise, Numbers and What Really Matters for Investors

The headlines painted this Budget as a turning point. I don’t think it is. This piece looks past the political theatre to what the Budget actually means for UK growth, gilts and equities over the next few years.

UK Budget: Noise, Numbers and What Really Matters for Investors

The headlines painted this Budget as a turning point. I don’t think it is. This piece looks past the political theatre to what the Budget actually means for UK growth, gilts and equities over the next few years.

Pre-Budget Politics: Lies, Lunacy and a £20bn Mistake

This week’s Budget is being sold on the back of a “black hole” in the public finances, blamed on Tory mismanagement, Brexit, Liz Truss and weak productivity. In reality, the problem is the scale of government spending and a set of fundamentally flawed productivity forecasts from the OBR. Those forecasts are now being used to justify around £20bn of tax rises that were never necessary – and which, in my view, still won’t stop the UK economy from surprising on the upside.

Pre-Budget Politics: Lies, Lunacy and a £20bn Mistake

This week’s Budget is being sold on the back of a “black hole” in the public finances, blamed on Tory mismanagement, Brexit, Liz Truss and weak productivity. In reality, the problem is the scale of government spending and a set of fundamentally flawed productivity forecasts from the OBR. Those forecasts are now being used to justify around £20bn of tax rises that were never necessary – and which, in my view, still won’t stop the UK economy from surprising on the upside.

UK Labour Market Data Update

The latest labour market data reveal a weakening jobs picture, falling wage growth and an almost certain December rate cut — all while the ONS’s flawed surveys continue to cloud the true state of the workforce.

UK Labour Market Data Update

The latest labour market data reveal a weakening jobs picture, falling wage growth and an almost certain December rate cut — all while the ONS’s flawed surveys continue to cloud the true state of the workforce.

Punch and Judy Show

The OBR’s “productivity crisis” is being used to justify tax rises on the basis of numbers that are little more than guesswork, while old-fashioned monetary indicators are quietly signalling that something much more positive is happening in the UK economy.

Punch and Judy Show

The OBR’s “productivity crisis” is being used to justify tax rises on the basis of numbers that are little more than guesswork, while old-fashioned monetary indicators are quietly signalling that something much more positive is happening in the UK economy.

Brexit: A convenient and popular scapegoat

Brexit remains the favourite excuse for Britain’s problems — but the evidence tells a different story. I argue that the UK’s economic performance since leaving the EU shows no sign of the supposed “Brexit damage” so often cited by politicians and the OBR.

Brexit: A convenient and popular scapegoat

Brexit remains the favourite excuse for Britain’s problems — but the evidence tells a different story. I argue that the UK’s economic performance since leaving the EU shows no sign of the supposed “Brexit damage” so often cited by politicians and the OBR.

Dog with a bone: UK productivity mismeasurement

I’ve said it before, but it bears repeating — the ONS’s productivity data simply doesn’t make sense. According to its latest figures, UK manufacturers are hiring more people to produce less, and the labour market is supposedly booming while productivity stagnates. None of this aligns with reality. The data is broken, yet it remains the foundation for critical economic forecasts and policy decisions.

Dog with a bone: UK productivity mismeasurement

I’ve said it before, but it bears repeating — the ONS’s productivity data simply doesn’t make sense. According to its latest figures, UK manufacturers are hiring more people to produce less, and the labour market is supposedly booming while productivity stagnates. None of this aligns with reality. The data is broken, yet it remains the foundation for critical economic forecasts and policy decisions.

You couldn't make it up

Once again, the data tell a very different story from the one the media insists on repeating. The UK is not “going bust” — it’s growing faster, investing more, and performing far better than the consensus narrative allows. Yet the Chancellor risks basing policy on flawed forecasts from institutions that can’t even measure the present accurately.

You couldn't make it up

Once again, the data tell a very different story from the one the media insists on repeating. The UK is not “going bust” — it’s growing faster, investing more, and performing far better than the consensus narrative allows. Yet the Chancellor risks basing policy on flawed forecasts from institutions that can’t even measure the present accurately.

UK Borrowing: Not the "Grim Reading" you were promised

August’s borrowing data disappointed on the surface, but anomalies in local authority revisions and VAT receipts suggest the picture is far less grim than the headlines. The OBR expects stronger numbers in the second half of the fiscal year.

UK Borrowing: Not the "Grim Reading" you were promised

August’s borrowing data disappointed on the surface, but anomalies in local authority revisions and VAT receipts suggest the picture is far less grim than the headlines. The OBR expects stronger numbers in the second half of the fiscal year.

Uneducated educated guesses

The UK’s fiscal debate has been hijacked by flawed forecasts and media scaremongering. Neil argues the OBR’s models are unreliable, the media’s narrative self-defeating, and that real-world evidence points to stronger growth, rising productivity, and no need for further tax hikes.

Uneducated educated guesses

The UK’s fiscal debate has been hijacked by flawed forecasts and media scaremongering. Neil argues the OBR’s models are unreliable, the media’s narrative self-defeating, and that real-world evidence points to stronger growth, rising productivity, and no need for further tax hikes.

The Self-Loathing Economy

The British media’s doom-laden narrative is not only unbalanced but risks creating a distorted reality. Let’s look at the facts, not the fear.

The Self-Loathing Economy

The British media’s doom-laden narrative is not only unbalanced but risks creating a distorted reality. Let’s look at the facts, not the fear.

Loose lips sink ships

The supposed £51bn “black hole” in the UK’s finances is nothing more than a product of NIESR’s excessively gloomy growth forecasts. The danger lies not in the numbers, but in the media narrative that risks becoming self-fulfilling.

Loose lips sink ships

The supposed £51bn “black hole” in the UK’s finances is nothing more than a product of NIESR’s excessively gloomy growth forecasts. The danger lies not in the numbers, but in the media narrative that risks becoming self-fulfilling.

Roundup of the week: 22 August 2025

Trump’s peace push falters, UK inflation hits 3.8%, stamp duty rumours rattle housing, and US labour data raises Fed cut hopes.

Roundup of the week: 22 August 2025

Trump’s peace push falters, UK inflation hits 3.8%, stamp duty rumours rattle housing, and US labour data raises Fed cut hopes.

Roundup of the week: 15 August 2025

This week’s roundup covers improving US–China trade sentiment, better-than-expected inflation, UK GDP outperformance, the cracks in UK energy policy, and market overreactions.

Roundup of the week: 15 August 2025

This week’s roundup covers improving US–China trade sentiment, better-than-expected inflation, UK GDP outperformance, the cracks in UK energy policy, and market overreactions.

Catch 22 – can we escape?

The media’s uncritical repetition of NIESR’s gloomy £50bn “black hole” forecast risks becoming a self-fulfilling prophecy, undermining confidence and slowing growth. The OBR’s more balanced outlook suggests the deficit is already falling, with a budget surplus possible from 2027/28 — meaning panicked tax hikes are unnecessary. The real danger is talking the economy into stagnation.

Catch 22 – can we escape?

The media’s uncritical repetition of NIESR’s gloomy £50bn “black hole” forecast risks becoming a self-fulfilling prophecy, undermining confidence and slowing growth. The OBR’s more balanced outlook suggests the deficit is already falling, with a budget surplus possible from 2027/28 — meaning panicked tax hikes are unnecessary. The real danger is talking the economy into stagnation.

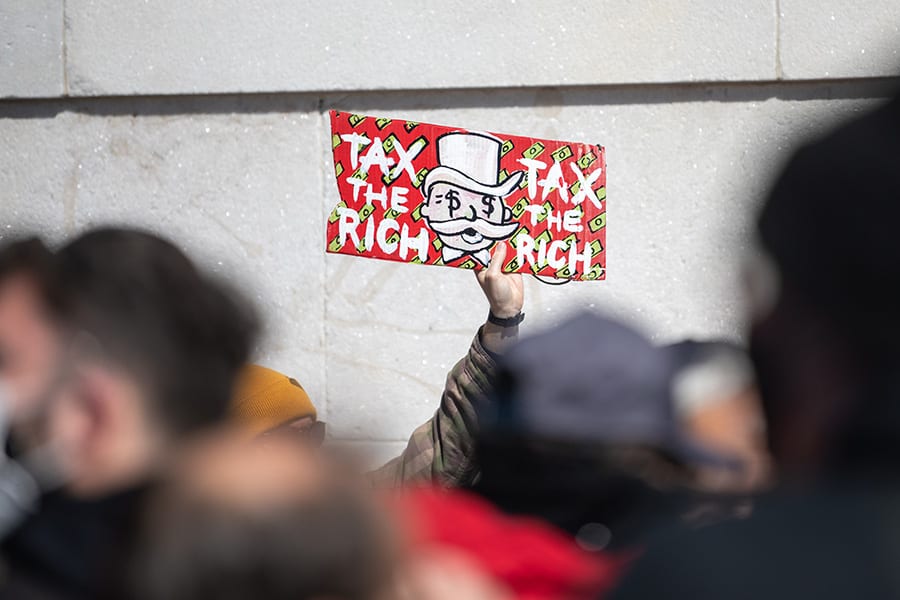

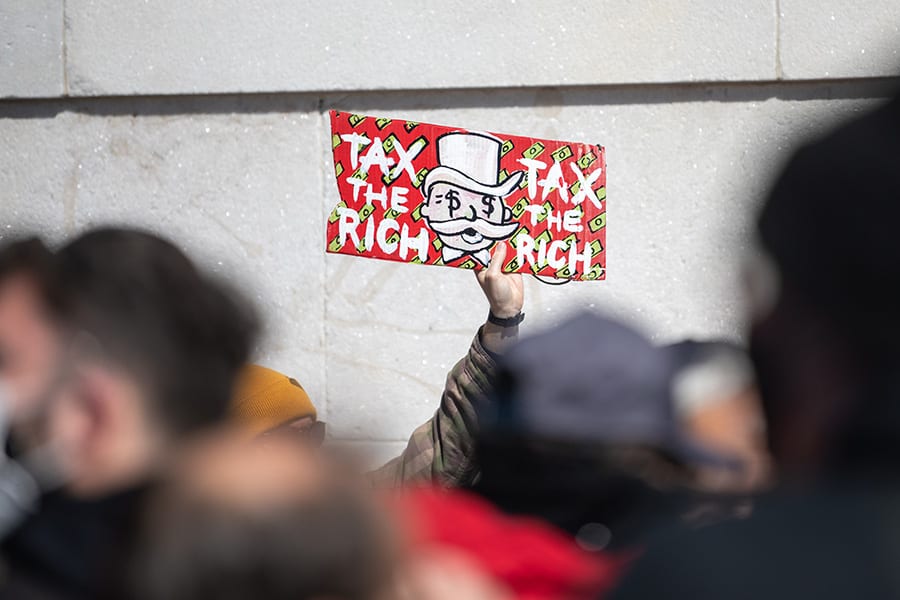

Theory becomes reality

I dig into the numbers behind Britain’s growing tax burden, as we lean ever more on a shrinking pool of taxpayers. If you think squeezing the “rich” is the answer, you’ll be interested in reading what the data actually says.

Theory becomes reality

I dig into the numbers behind Britain’s growing tax burden, as we lean ever more on a shrinking pool of taxpayers. If you think squeezing the “rich” is the answer, you’ll be interested in reading what the data actually says.

Roundup of the week: 11 July 2025

This week, Trump was back in the spotlight with another round of tariff announcements — but markets barely blinked. Meanwhile, the OBR delivered another doomsday forecast, and I took a closer look at the Financial Stability Report. On the corporate side, some companies impressed, and renewable energy stocks rallied on US policy clarity.

Roundup of the week: 11 July 2025

This week, Trump was back in the spotlight with another round of tariff announcements — but markets barely blinked. Meanwhile, the OBR delivered another doomsday forecast, and I took a closer look at the Financial Stability Report. On the corporate side, some companies impressed, and renewable energy stocks rallied on US policy clarity.

Why UK banks are still deeply undervalued

UK banks remain structurally undervalued despite solid performance. I explain why I believe the discount persists—and why it might finally be about to close.

Why UK banks are still deeply undervalued

UK banks remain structurally undervalued despite solid performance. I explain why I believe the discount persists—and why it might finally be about to close.

Has the penny dropped on energy prices?

Examining the UK’s new industrial energy policy and questioning whether the government is finally facing up to the hidden costs of its net-zero ambitions

Has the penny dropped on energy prices?

Examining the UK’s new industrial energy policy and questioning whether the government is finally facing up to the hidden costs of its net-zero ambitions

Volatility is the price of admission

It’s been a noisy, chaotic first half to 2025 — wars, tariffs, stimulus packages, volatile oil, and plenty of political drama.

Volatility is the price of admission

It’s been a noisy, chaotic first half to 2025 — wars, tariffs, stimulus packages, volatile oil, and plenty of political drama.

Roundup of the week: 20 June 2025

Reflecting on a week shaped by war, interest rate decisions, and market reaction, and why long-term investors should continue looking beyond the headlines.

Roundup of the week: 20 June 2025

Reflecting on a week shaped by war, interest rate decisions, and market reaction, and why long-term investors should continue looking beyond the headlines.

The global chip cycle is turning – and one stock in my strategy is already leading the charge

The semiconductor industry has faced a tough few years, but signs now point to recovery. With AI driving new demand and inventory pressures easing, I’ve got select chipmakers in my strategies.

The global chip cycle is turning – and one stock in my strategy is already leading the charge

The semiconductor industry has faced a tough few years, but signs now point to recovery. With AI driving new demand and inventory pressures easing, I’ve got select chipmakers in my strategies.

Penetrating the fog of UK labour market data

April’s UK labour market data may look confusing at first glance — with employment and unemployment both rising — but the underlying trends point to improving productivity, falling inflation, and a healthier path for the economy.

Penetrating the fog of UK labour market data

April’s UK labour market data may look confusing at first glance — with employment and unemployment both rising — but the underlying trends point to improving productivity, falling inflation, and a healthier path for the economy.

Britain’s AI paradox

Nvidia’s CEO just told the UK, to its face, what many of us already knew: we lead the world in research but have failed to build the infrastructure — financial or physical — to turn it into economic success.

Britain’s AI paradox

Nvidia’s CEO just told the UK, to its face, what many of us already knew: we lead the world in research but have failed to build the infrastructure — financial or physical — to turn it into economic success.

Roundup of the week: 13 June 2025

Global trade steadies, UK data surprises on the upside, and two undervalued sectors (semiconductors and housebuilders) show clear signs of recovery.

Roundup of the week: 13 June 2025

Global trade steadies, UK data surprises on the upside, and two undervalued sectors (semiconductors and housebuilders) show clear signs of recovery.

Big beautiful (electricity) bill

UK energy bills are soaring—but not for the reasons ministers claim. I dig into the data and uncover the real economic costs of our dash to net zero.

Big beautiful (electricity) bill

UK energy bills are soaring—but not for the reasons ministers claim. I dig into the data and uncover the real economic costs of our dash to net zero.

Oikophobia and the decline narrative

I don’t buy into the idea that Britain is broken beyond repair. This piece is a reflection on oikophobia, decline narratives, and why I think there’s still plenty to be optimistic about—especially if you know where to look.

Oikophobia and the decline narrative

I don’t buy into the idea that Britain is broken beyond repair. This piece is a reflection on oikophobia, decline narratives, and why I think there’s still plenty to be optimistic about—especially if you know where to look.

.jpg)

Neil's Mid-Year 2025 Market Update

Neil shares why the headlines don’t tell the full story, what he got right and wrong back in January and where he’s seeing real investment potential right now.

.jpg)

Neil's Mid-Year 2025 Market Update

Neil shares why the headlines don’t tell the full story, what he got right and wrong back in January and where he’s seeing real investment potential right now.

Broader Appeal

BioNTech’s $11.1bn deal with Bristol Myers Squibb is a pivotal moment for biotech investors. Neil explains why this validates the company’s cancer pipeline and highlights the opportunity in undervalued mature biotech stocks.

Broader Appeal

BioNTech’s $11.1bn deal with Bristol Myers Squibb is a pivotal moment for biotech investors. Neil explains why this validates the company’s cancer pipeline and highlights the opportunity in undervalued mature biotech stocks.

Are You Not Cheered Up?

In a week full of gloomy headlines about public borrowing and tax hikes, the actual data tells a more optimistic story. I’m not joining the gloom. I still expect two more cuts this year and growth to exceed consensus.

Are You Not Cheered Up?

In a week full of gloomy headlines about public borrowing and tax hikes, the actual data tells a more optimistic story. I’m not joining the gloom. I still expect two more cuts this year and growth to exceed consensus.

Inflation Surprise: oops, I got that wrong

April’s inflation number came in higher than I expected — 3.5% year-on-year vs my forecast of 3%. But the detail matters. This isn’t driven by the underlying economy.

Inflation Surprise: oops, I got that wrong

April’s inflation number came in higher than I expected — 3.5% year-on-year vs my forecast of 3%. But the detail matters. This isn’t driven by the underlying economy.

Global Equity Market Update

Neil's latest view on global equity markets. The UK looks increasingly resilient, US valuation gaps are widening, and China’s policy response is gaining traction as trade tensions ease.

Global Equity Market Update

Neil's latest view on global equity markets. The UK looks increasingly resilient, US valuation gaps are widening, and China’s policy response is gaining traction as trade tensions ease.

Warren Buffett to step back

I owe the great man a debt of gratitude. Throughout my career as an investor, I have learned more from him than from any other writer, commentator, or colleague.

Warren Buffett to step back

I owe the great man a debt of gratitude. Throughout my career as an investor, I have learned more from him than from any other writer, commentator, or colleague.

Panic First, Think Later

Markets and boardrooms panicked after Trump’s tariffs. They shouldn’t have. Lloyds made a pointless provision, while Rolls-Royce stayed the course. Meanwhile, bond yields and energy prices are falling, and the UK housing market is showing real signs of life. Rate cuts are overdue.

Panic First, Think Later

Markets and boardrooms panicked after Trump’s tariffs. They shouldn’t have. Lloyds made a pointless provision, while Rolls-Royce stayed the course. Meanwhile, bond yields and energy prices are falling, and the UK housing market is showing real signs of life. Rate cuts are overdue.

US economy contracts… or does it?

The headlines scream contraction, but the underlying data tell a different story. Once again, I believe the consensus has it wrong about the US economy.

US economy contracts… or does it?

The headlines scream contraction, but the underlying data tell a different story. Once again, I believe the consensus has it wrong about the US economy.

Tariff tension turning point?

Despite an avalanche of dire forecasts about Trump’s tariffs triggering global recession, I remain a minority voice — and, so far, a correct one. Here's my latest take on the US, China and UK economies.

Tariff tension turning point?

Despite an avalanche of dire forecasts about Trump’s tariffs triggering global recession, I remain a minority voice — and, so far, a correct one. Here's my latest take on the US, China and UK economies.

UK Economy update – it’s a ripper!

Neil takes aim at the MPC and OBR once again, highlighting their consistently over-pessimistic inflation and growth forecasts. Drawing on the latest March CPI figures and underlying economic data, he argues that the UK’s inflation outlook is improving faster than the official forecasts recognise.

UK Economy update – it’s a ripper!

Neil takes aim at the MPC and OBR once again, highlighting their consistently over-pessimistic inflation and growth forecasts. Drawing on the latest March CPI figures and underlying economic data, he argues that the UK’s inflation outlook is improving faster than the official forecasts recognise.

Trump Blinks, Markets Begin to Stabilise

Trump’s tariff threats are being quietly walked back. Neil Woodford explains why markets overreacted—and what’s likely to happen next.

Trump Blinks, Markets Begin to Stabilise

Trump’s tariff threats are being quietly walked back. Neil Woodford explains why markets overreacted—and what’s likely to happen next.

WTF: Worldwide Trump Fallout

Last week’s sweeping US tariff announcement sparked a market rout. But the panic is most likely overblown.The global economy is not headed for recession. investors should stay focused, not fearful.

WTF: Worldwide Trump Fallout

Last week’s sweeping US tariff announcement sparked a market rout. But the panic is most likely overblown.The global economy is not headed for recession. investors should stay focused, not fearful.

Spring Statement 2025: Some observations

The Chancellor’s Spring Statement was surprisingly upbeat, highlighting better-than-expected growth and lower-than-anticipated borrowing.

Spring Statement 2025: Some observations

The Chancellor’s Spring Statement was surprisingly upbeat, highlighting better-than-expected growth and lower-than-anticipated borrowing.

The Queen of wishful thinking

Neil Woodford responds to the upcoming Spring Statement and the fiscal reality now facing the government. He argues that stalled growth, rising taxes, and excessive public spending have pushed the UK economy off course—and that the government’s growth narrative is built more on hope than policy.

The Queen of wishful thinking

Neil Woodford responds to the upcoming Spring Statement and the fiscal reality now facing the government. He argues that stalled growth, rising taxes, and excessive public spending have pushed the UK economy off course—and that the government’s growth narrative is built more on hope than policy.

Not good enough

Another day, another data blunder at the ONS—this time affecting price indices and potentially leading to major revisions in GDP estimates. How much bad data can policymakers rely on before real damage is done?

Not good enough

Another day, another data blunder at the ONS—this time affecting price indices and potentially leading to major revisions in GDP estimates. How much bad data can policymakers rely on before real damage is done?

Is Trump Pushing America Into a Recession?

Neil takes a critical look at Trump’s tariff strategy and its real impact on the U.S. economy. Are fears of a recession justified, or is Trump simply negotiating better trade terms?

Is Trump Pushing America Into a Recession?

Neil takes a critical look at Trump’s tariff strategy and its real impact on the U.S. economy. Are fears of a recession justified, or is Trump simply negotiating better trade terms?

Data vs Common Sense: Fight!

The latest ONS data says manufacturing output is down more than 12% since 2020. At the same time, manufacturing employment has actually gone up slightly. How can this be?

Data vs Common Sense: Fight!

The latest ONS data says manufacturing output is down more than 12% since 2020. At the same time, manufacturing employment has actually gone up slightly. How can this be?

Calm analysis or hysteria?

Recent market volatility has investors worried about a US recession, blaming Trump’s tariffs and economic policies. But is this hysteria justified?

Calm analysis or hysteria?

Recent market volatility has investors worried about a US recession, blaming Trump’s tariffs and economic policies. But is this hysteria justified?

Labour's biggest mistakes

Neil takes a critical look at the economic policies of the Labour government since their election victory. He argues their agenda—particularly on energy, taxation, and expanding state control—is making economic growth harder, not easier.

Labour's biggest mistakes

Neil takes a critical look at the economic policies of the Labour government since their election victory. He argues their agenda—particularly on energy, taxation, and expanding state control—is making economic growth harder, not easier.

Winners and losers

The government needs to be honest about the real costs of its decisions. It’s possible to balance defence, energy, and climate priorities without undermining economic growth—but only if we stop pretending trade-offs don’t exist.

Winners and losers

The government needs to be honest about the real costs of its decisions. It’s possible to balance defence, energy, and climate priorities without undermining economic growth—but only if we stop pretending trade-offs don’t exist.

Trump, Ukraine & The Path to Peace

Donald Trump’s recent comments about Ukraine and Zelensky have sparked outrage. But is there a hidden strategy behind them?

Trump, Ukraine & The Path to Peace

Donald Trump’s recent comments about Ukraine and Zelensky have sparked outrage. But is there a hidden strategy behind them?

You can't manage what you can't measure

The UK’s economic data is broken. The Bank of England and ONS publish figures that are inconsistent, often revised, and fundamentally unreliable. This mismeasurement isn’t just a statistical headache—it leads to bad decisions on interest rates, public spending, and business policy.

You can't manage what you can't measure

The UK’s economic data is broken. The Bank of England and ONS publish figures that are inconsistent, often revised, and fundamentally unreliable. This mismeasurement isn’t just a statistical headache—it leads to bad decisions on interest rates, public spending, and business policy.

Not a Trumpet Voluntary

Most investors assume the UK stock market will continue to lag behind the US, but what if that assumption is wrong? With the FTSE 100 already ahead of the S&P 500 this year, could this be the start of a major shift?

Not a Trumpet Voluntary

Most investors assume the UK stock market will continue to lag behind the US, but what if that assumption is wrong? With the FTSE 100 already ahead of the S&P 500 this year, could this be the start of a major shift?

A Dog's Dinner

The Bank of England’s latest rate decision and forecast update was supposed to provide clarity. Instead, it delivered a masterclass in contradiction. The MPC cut rates while simultaneously increasing inflation projections and slashing growth forecasts—none of which add up.

A Dog's Dinner

The Bank of England’s latest rate decision and forecast update was supposed to provide clarity. Instead, it delivered a masterclass in contradiction. The MPC cut rates while simultaneously increasing inflation projections and slashing growth forecasts—none of which add up.

Beware of witches

Trump’s tariffs are being blamed for market weakness—but is that really the cause? Too often, market movements are explained with misplaced certainty. In this post, I break down why investors should be wary of convenient narratives and focus on real fundamentals.

Beware of witches

Trump’s tariffs are being blamed for market weakness—but is that really the cause? Too often, market movements are explained with misplaced certainty. In this post, I break down why investors should be wary of convenient narratives and focus on real fundamentals.

Taking a risk

Politicians and the media keep pushing a relentlessly negative narrative about the UK economy. But does it match reality? Here's why I remain optimistic despite the challenges ahead.

Taking a risk

Politicians and the media keep pushing a relentlessly negative narrative about the UK economy. But does it match reality? Here's why I remain optimistic despite the challenges ahead.

AI: Hype or genuine investment opportunity?

AI is being heralded as the fourth industrial revolution, but will it reshape the world like its predecessors, or is it another overhyped trend with unclear profitability? While investors pile into Big Tech, betting on the AI boom, a new development from China is raising uncomfortable questions.

AI: Hype or genuine investment opportunity?

AI is being heralded as the fourth industrial revolution, but will it reshape the world like its predecessors, or is it another overhyped trend with unclear profitability? While investors pile into Big Tech, betting on the AI boom, a new development from China is raising uncomfortable questions.

Well Kept Secrets

I’ve been thinking about how much attention the US equity market gets. While its dominance in global indices is undeniable, could it be causing investors to miss out on other, less obvious opportunities? In this piece, I share my thoughts on what’s being overlooked and why it matters for investors.

Well Kept Secrets

I’ve been thinking about how much attention the US equity market gets. While its dominance in global indices is undeniable, could it be causing investors to miss out on other, less obvious opportunities? In this piece, I share my thoughts on what’s being overlooked and why it matters for investors.

How Did We Get Here?

Trump’s presidency has already sparked dramatic changes—not just in politics but in the corporate world. From free speech to ESG and DEI, this article explores how his election is reshaping global business culture and raising questions about honesty, accountability, and the future of capitalism.

How Did We Get Here?

Trump’s presidency has already sparked dramatic changes—not just in politics but in the corporate world. From free speech to ESG and DEI, this article explores how his election is reshaping global business culture and raising questions about honesty, accountability, and the future of capitalism.

From ‘Uninvestable’ to Opportunity: Rethinking China’s Market

China’s equity market has faced scepticism, with many branding it “uninvestable” due to economic challenges, regulatory interventions, and declining corporate profits. Yet, recent government stimulus and low valuations signal that this perception might be ripe for re-evaluation. Could China offer untapped opportunities in 2025?

From ‘Uninvestable’ to Opportunity: Rethinking China’s Market

China’s equity market has faced scepticism, with many branding it “uninvestable” due to economic challenges, regulatory interventions, and declining corporate profits. Yet, recent government stimulus and low valuations signal that this perception might be ripe for re-evaluation. Could China offer untapped opportunities in 2025?

An ordinary popular delusion

The UK financial media is buzzing with speculation about rising gilt yields, but much of it misses the mark. Contrary to popular narratives, higher borrowing isn’t the culprit. Instead, the real story lies across the Atlantic, in the US Treasury market and Trump’s economic policies. Here’s why this matters for UK markets—and why I believe this will be short-lived.

An ordinary popular delusion

The UK financial media is buzzing with speculation about rising gilt yields, but much of it misses the mark. Contrary to popular narratives, higher borrowing isn’t the culprit. Instead, the real story lies across the Atlantic, in the US Treasury market and Trump’s economic policies. Here’s why this matters for UK markets—and why I believe this will be short-lived.

A Sprinkle of Festive Cheer

Amid the doom and gloom surrounding the UK economy, the facts tell a different story. Despite unhelpful messaging from the government and relentless media negativity, I still believe the UK is poised for strong growth in 2025 and 2026.

A Sprinkle of Festive Cheer

Amid the doom and gloom surrounding the UK economy, the facts tell a different story. Despite unhelpful messaging from the government and relentless media negativity, I still believe the UK is poised for strong growth in 2025 and 2026.

My global economic outlook for Q1 2025

Since I launched Woodford Views in April, I've shared my thoughts on markets, the economy, and the broader trends shaping our world. With 2025 on the horizon, I wanted to share my views on what I think the key drivers of the global economy and financial markets will be in the first part of next year.

My global economic outlook for Q1 2025

Since I launched Woodford Views in April, I've shared my thoughts on markets, the economy, and the broader trends shaping our world. With 2025 on the horizon, I wanted to share my views on what I think the key drivers of the global economy and financial markets will be in the first part of next year.

The Woodford Story part 1

When I launched Woodford Views earlier this year I said I would tell the story of what really happened at Woodford Investment Management. This is the first part of that story.

The Woodford Story part 1

When I launched Woodford Views earlier this year I said I would tell the story of what really happened at Woodford Investment Management. This is the first part of that story.

The art or science of investment decision making

Investment decisions shouldn’t be driven by emotion or FOMO, but by thoughtful analysis and valuation. In this article, I share my approach to evaluating businesses, understanding uncertainty, and finding undervalued opportunities that others might overlook.

The art or science of investment decision making

Investment decisions shouldn’t be driven by emotion or FOMO, but by thoughtful analysis and valuation. In this article, I share my approach to evaluating businesses, understanding uncertainty, and finding undervalued opportunities that others might overlook.

Does Valuation Still Matter?

History tells us that elevated valuations often lead to lower returns, yet US equities continue to climb. Are we ignoring hard truths about investing, or has the market rewritten the rules?

Does Valuation Still Matter?

History tells us that elevated valuations often lead to lower returns, yet US equities continue to climb. Are we ignoring hard truths about investing, or has the market rewritten the rules?

Copy Nothing, Risk Everything?

Jaguar’s bold rebrand and shift to an all-electric lineup by 2026 have sparked intrigue and criticism. European carmakers are racing to adapt to EVs, fierce competition, and shifting customer attitudes.

Copy Nothing, Risk Everything?

Jaguar’s bold rebrand and shift to an all-electric lineup by 2026 have sparked intrigue and criticism. European carmakers are racing to adapt to EVs, fierce competition, and shifting customer attitudes.

Lies, Damned Lies, and Misleading Data

The UK economy grew by just 0.1% in Q3—or did it? Discover why outdated measurement methods distort the story and what this means for productivity and policymaking.

Lies, Damned Lies, and Misleading Data

The UK economy grew by just 0.1% in Q3—or did it? Discover why outdated measurement methods distort the story and what this means for productivity and policymaking.

Very interesting times

The US election results are in, and markets are on the move. With Trump back in the White House and a Republican sweep in Congress, we’re seeing big shifts across equities, bonds, and currencies. But are the markets overestimating the inflationary impact of Trump’s policies?

Very interesting times

The US election results are in, and markets are on the move. With Trump back in the White House and a Republican sweep in Congress, we’re seeing big shifts across equities, bonds, and currencies. But are the markets overestimating the inflationary impact of Trump’s policies?

Trump Wins: Markets React, China Braces

The US election results are in. With Trump’s victory and a Republican-led Senate, what will this new political landscape mean for global growth, inflation, and upcoming central bank decisions?

Trump Wins: Markets React, China Braces

The US election results are in. With Trump’s victory and a Republican-led Senate, what will this new political landscape mean for global growth, inflation, and upcoming central bank decisions?

UK Budget Fallout and the Big Week Ahead

Reflecting on the UK budget and its limited impact on growth, while looking ahead to a major week for global markets with the US elections, China’s stimulus, and potential UK rate cuts.

UK Budget Fallout and the Big Week Ahead

Reflecting on the UK budget and its limited impact on growth, while looking ahead to a major week for global markets with the US elections, China’s stimulus, and potential UK rate cuts.

Budget analysis: Much Ado About… Not Much

Despite political fanfare, the UK budget offers little to shift the economic outlook. With higher taxes and spending but no real impact on growth forecasts, the budget’s medium-term effects are minimal.

Budget analysis: Much Ado About… Not Much

Despite political fanfare, the UK budget offers little to shift the economic outlook. With higher taxes and spending but no real impact on growth forecasts, the budget’s medium-term effects are minimal.

Pre-Budget perspective

As background to today’s much-anticipated budget, I thought I should provide some subjective perspective on some of the key underlying issues that Rachael Reeves will talk about later today.

Pre-Budget perspective

As background to today’s much-anticipated budget, I thought I should provide some subjective perspective on some of the key underlying issues that Rachael Reeves will talk about later today.

Global economic view, October 2024

What’s driving the global economy in 2025? I explore key trends in the US, UK, and China, focusing on inflation, trade tensions, and interest rates. The outlook for the UK may surprise you, but there are still significant challenges on the horizon.

Global economic view, October 2024

What’s driving the global economy in 2025? I explore key trends in the US, UK, and China, focusing on inflation, trade tensions, and interest rates. The outlook for the UK may surprise you, but there are still significant challenges on the horizon.

Popular myth massacre

Unpacking the myths around UK gilt yields and government debt. Discover why the budget deficit has no real impact on long-term yields and what truly drives market rates. Inflation, not debt, is the key player.

Popular myth massacre

Unpacking the myths around UK gilt yields and government debt. Discover why the budget deficit has no real impact on long-term yields and what truly drives market rates. Inflation, not debt, is the key player.

Boring but important

Recent GDP revisions reveal a £60 billion boost for 2024/5, generating £22 billion more in tax revenue. With the ‘black hole’ in the nation’s finances shrinking, the Chancellor now has room to adjust spending without raising taxes. Find out how this could impact the upcoming budget.

Boring but important

Recent GDP revisions reveal a £60 billion boost for 2024/5, generating £22 billion more in tax revenue. With the ‘black hole’ in the nation’s finances shrinking, the Chancellor now has room to adjust spending without raising taxes. Find out how this could impact the upcoming budget.

Clarity plays confusion

Explore the shortcomings of the Bank of England and OBR’s economic forecasting and their impact on UK monetary policy. This blog compares their approach to the clarity of the US Federal Reserve’s communication, highlighting the need for improvement in UK economic governance.

Clarity plays confusion

Explore the shortcomings of the Bank of England and OBR’s economic forecasting and their impact on UK monetary policy. This blog compares their approach to the clarity of the US Federal Reserve’s communication, highlighting the need for improvement in UK economic governance.

UK public debt: a concern?

Explore the UK’s public debt situation, how it grew due to the pandemic and energy crisis, and what its future looks like. This post examines whether the debt is a real constraint on government spending, public services, and economic growth, offering historical and current context to the debate.

UK public debt: a concern?

Explore the UK’s public debt situation, how it grew due to the pandemic and energy crisis, and what its future looks like. This post examines whether the debt is a real constraint on government spending, public services, and economic growth, offering historical and current context to the debate.

A smooth sea never made a skilled sailor

Wild swings in global markets have left investors reeling. Discover what triggered Japan's record plunge and how to navigate such turmoil by focusing on long-term investment strategies.

A smooth sea never made a skilled sailor

Wild swings in global markets have left investors reeling. Discover what triggered Japan's record plunge and how to navigate such turmoil by focusing on long-term investment strategies.

Lucky Labour

I critique the OBR’s inaccurate economic forecasts and explore how underestimations can result in unexpected tax revenue windfalls. This extra revenue could allow the incoming Labour administration to fund its promises without raising taxes.

Lucky Labour

I critique the OBR’s inaccurate economic forecasts and explore how underestimations can result in unexpected tax revenue windfalls. This extra revenue could allow the incoming Labour administration to fund its promises without raising taxes.

Red faces?

The UK economy grew by 0.4% in May, double the expected result. Yet more evidence that the forecast models in use by those overseeing interest rates and fiscal policy are giving them the wrong answers.

Red faces?

The UK economy grew by 0.4% in May, double the expected result. Yet more evidence that the forecast models in use by those overseeing interest rates and fiscal policy are giving them the wrong answers.

General Election 2024: Match Report

In this article we reflect on the outcomes of the 2024 UK General Election, noting the historical peculiarities of UK elections due to the first-past-the-post system

General Election 2024: Match Report

In this article we reflect on the outcomes of the 2024 UK General Election, noting the historical peculiarities of UK elections due to the first-past-the-post system

It isn't the economy, stupid!

Discussing the apparent disconnect between the UK’s robust economic indicators and the political outcomes expected in today's election.

It isn't the economy, stupid!

Discussing the apparent disconnect between the UK’s robust economic indicators and the political outcomes expected in today's election.

The UK tech sector – missing in action?

Why is the UK’s tech sector missing in action on the equity market? Discover the challenges faced by tech companies, why UK innovations thrive abroad, and potential solutions to revitalise the sector.

The UK tech sector – missing in action?

Why is the UK’s tech sector missing in action on the equity market? Discover the challenges faced by tech companies, why UK innovations thrive abroad, and potential solutions to revitalise the sector.

GDP data: here we go again!

Yesterday, the ONS published April's GDP growth number. Although the outcome was better than the consensus expected, it has predictably led to a chorus of negative press.

GDP data: here we go again!

Yesterday, the ONS published April's GDP growth number. Although the outcome was better than the consensus expected, it has predictably led to a chorus of negative press.

General Election

With the General Election date set, many predict a Labour landslide. But history tells a different story. Could we see a surprise in the making?

General Election

With the General Election date set, many predict a Labour landslide. But history tells a different story. Could we see a surprise in the making?

Is China's rally real?

Is the recent rally in China’s equity markets a signal of robust recovery or just a fleeting reprieve? As we dissect China's complex economic strategies and global interactions, find out what these changes could mean for investors and the broader global market.

Is China's rally real?

Is the recent rally in China’s equity markets a signal of robust recovery or just a fleeting reprieve? As we dissect China's complex economic strategies and global interactions, find out what these changes could mean for investors and the broader global market.

Who's in charge of UK inflation?

Are higher interest rates still the remedy for inflation as they have been in the past? I challenge some deep-seated economic theories, suggesting that what we thought we knew might not hold up under current conditions.

Who's in charge of UK inflation?

Are higher interest rates still the remedy for inflation as they have been in the past? I challenge some deep-seated economic theories, suggesting that what we thought we knew might not hold up under current conditions.

The OBR: what would Einstein say?

Challenging the reliance on flawed economic forecasts by institutions like the OBR, which consistently misguides government policy and public opinion. Why do we trust projections that so often miss the mark?

The OBR: what would Einstein say?

Challenging the reliance on flawed economic forecasts by institutions like the OBR, which consistently misguides government policy and public opinion. Why do we trust projections that so often miss the mark?

Can the UK equity market recover?

There are reasons for optimism about the UK equity market's recovery. We look at the transition from Defined Benefit to Defined Contribution schemes, increased capital inflows from these pensions, and the potential for valuation adjustments to begin a mean reversion, suggesting that the historically low prices of UK equities might correct to higher, more typical levels.

Can the UK equity market recover?

There are reasons for optimism about the UK equity market's recovery. We look at the transition from Defined Benefit to Defined Contribution schemes, increased capital inflows from these pensions, and the potential for valuation adjustments to begin a mean reversion, suggesting that the historically low prices of UK equities might correct to higher, more typical levels.

A quarter century of damaging reforms

Examining how regulatory reforms over the past 25 years have reshaped and challenged the UK equity market. A crucial read for understanding the deep and lasting effects on capital growth and economic vitality.

A quarter century of damaging reforms

Examining how regulatory reforms over the past 25 years have reshaped and challenged the UK equity market. A crucial read for understanding the deep and lasting effects on capital growth and economic vitality.

Look behind the spin

Exploring the UK economy's resilience, this blog challenges the prevalent pessimistic narratives. Highlighting discrepancies in housing market data and questioning gloomy economic forecasts from major institutions, we present evidence that suggests a more optimistic economic outlook than commonly portrayed.

Look behind the spin

Exploring the UK economy's resilience, this blog challenges the prevalent pessimistic narratives. Highlighting discrepancies in housing market data and questioning gloomy economic forecasts from major institutions, we present evidence that suggests a more optimistic economic outlook than commonly portrayed.

The UK stock market: not damaged goods

This post explores the reasons behind the UK stock market's underperformance over the last decade (or more) and challenges the common belief that economic performance is to blame. We examine deeper causes, such as regulatory and political influences, and show potential for a promising turnaround for UK equities.

The UK stock market: not damaged goods

This post explores the reasons behind the UK stock market's underperformance over the last decade (or more) and challenges the common belief that economic performance is to blame. We examine deeper causes, such as regulatory and political influences, and show potential for a promising turnaround for UK equities.

UK base rates: how important are they?

Exploring the impact of UK base rates on economic growth, we reveal how broader financial factors might drive a stronger-than-expected economic performance, regardless of rate changes.

UK base rates: how important are they?

Exploring the impact of UK base rates on economic growth, we reveal how broader financial factors might drive a stronger-than-expected economic performance, regardless of rate changes.

Reasons to be Cheerful, Part 3

Part 3 of 'Reasons to Be Cheerful' challenges the notion of 'falling living standards' in the UK, examining the realities of wages, housing, and employment. This final instalment offers a robust argument that despite recent hardships, the UK is poised for a promising period of growth, refuting the pervasive economic pessimism with hard evidence and a dose of optimism.

Reasons to be Cheerful, Part 3

Part 3 of 'Reasons to Be Cheerful' challenges the notion of 'falling living standards' in the UK, examining the realities of wages, housing, and employment. This final instalment offers a robust argument that despite recent hardships, the UK is poised for a promising period of growth, refuting the pervasive economic pessimism with hard evidence and a dose of optimism.

Reasons to be Cheerful, Part 2

Exploring the often grim narrative surrounding UK public finances, offering a fresh perspective on the country’s indebtedness and how government spending, particularly in response to the COVID pandemic and energy crises, has shaped the fiscal landscape.

Reasons to be Cheerful, Part 2

Exploring the often grim narrative surrounding UK public finances, offering a fresh perspective on the country’s indebtedness and how government spending, particularly in response to the COVID pandemic and energy crises, has shaped the fiscal landscape.